An Unbiased View of Short-term Loan Canada

Wiki Article

Short-term Loan Canada Fundamentals Explained

Table of ContentsThe Greatest Guide To Short-term Loan CanadaWhat Does Short-term Loan Canada Do?The smart Trick of Short-term Loan Canada That Nobody is DiscussingGetting The Short-term Loan Canada To WorkUnknown Facts About Short-term Loan CanadaRumored Buzz on Short-term Loan Canada

The estimations and also amortization timetable produced are: (i) based upon the precision as well as efficiency of the data you have gone into, (ii) based upon presumptions that are thought to be practical, as well as (iii) for estimate purposes only as well as must not be trusted for certain financial or various other advice. When you make your credit rating application, rates of interest may have altered or may be various as a result of info had in your application.

They are unprotected financings, implying that you do not need to secure your car loan against your house or vehicle or any type of various other residential property. If you get a temporary lending you are required to pay off the very same amount monthly to the lending institution until the lending and the interest are settled.

4 Easy Facts About Short-term Loan Canada Explained

9% You after that are needed to settle 178. 23 to the lending institution monthly for the next three months. After the 3 months you will certainly have paid off a total of 534. 69. It would have cost you 34. 69 to borrow that 500. At Cash, Girl, we make discovering a short-term financing quick as well as simple.We after that present your application to the 30+ lending institutions on our panel to find the lending institution probably to approve your application, at the most effective APR available to you. We will then route you right to that lenders web site to complete your application. Our solution is cost-free and thanks to our soft search innovation has no effect on your credit report rating.

By contrast, a temporary finance is spread over 2 or even more months. For several people, spreading out the expense over numerous months makes the car loan settlements much more inexpensive.

What Does Short-term Loan Canada Mean?

The Greatest Guide To Short-term Loan Canada

If you are contrasting loans online, you may find that the rate of interest on short-term car loan products look high when compared to heading finance rates promoted by high street financial institutions or developing cultures. One essential factor for this is that short-term lending institutions accommodate providing to those with bad credit scores profiles or no credit report background in all.This is true of any kind of car loan or credit product, not just temporary finances. On the other hand, if you satisfy all your payments in complete and on time then this might suggest that you can be trusted to handle credit report well as well as might enhance your credit history rating.

If you meet all these requirements, after that yes you are qualified to use. If you are battling with your finances important site and concerned concerning your debts then there are a variety of organisations that you can resort to for free as well as neutral suggestions. See the links listed below.

Everything about Short-term Loan Canada

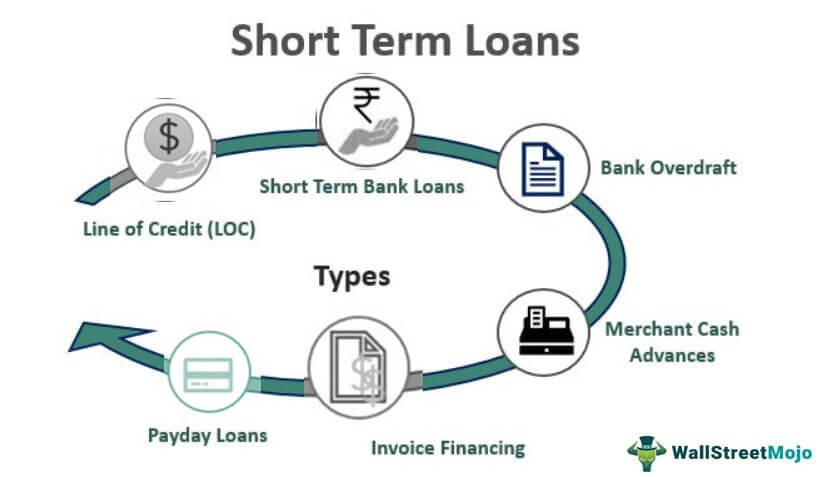

Payday advance loan are short-term finances of approximately $1,500 provided in exchange for a post-dated paycheque or other pre-authorized debit that the lending institution uses for future repayment of the finance, plus any kind of interest as well as charges. If the payday advance loan is not paid off on schedule, it can lead to more rate of interest as well as fees. short-term loan canada.For instance, if you obtain $500 for a payday finance, you can be billed up to $75 in passion as well as fees. This may not appear like a great deal of cash, however the short duration of a payday advance implies they check out this site have much greater passion charges than other kinds of lendings.

Let's calculate what a payday advance loan could cost you. Say that: The quantity of your following paycheque will be $1,000 You wish to obtain a payday advance loan for $300 The fee to obtain the funding is $45 The total price to pay back the finance is $345. That means the quantity you will certainly get from your next paycheque will certainly be $655.

The Of Short-term Loan Canada

Cash advance lending institutions are managed in B.C., meaning any company that provides payday advance need to be licensed and comply with laws established by the rural federal government. You can examine to see if a business is licensed with this. Business needs to also present the permit any place it supplies cash advance finances, whether online or in-person.If you have concerns or interest in a cash advance financing or loan provider, contact Consumer Protection BC.

If high inflation is pressing your spending plan, you aren't alone. A current study by Finder discovered that 36 per cent of Canadian customers stated their major factor for securing a loan is to cover costs for rental fee, home mortgage, food as well as transport. With inflation at 7. 6 per cent, several Canadians are resorting to car loans to pay for needs.

Report this wiki page